January 28, 2026 |

| Funds in focus: Brompton U.S Cash Flow Kings ETF, Brompton Canadian Cash Flow Kings ETF, Brompton International Cash Flow Kings ETF

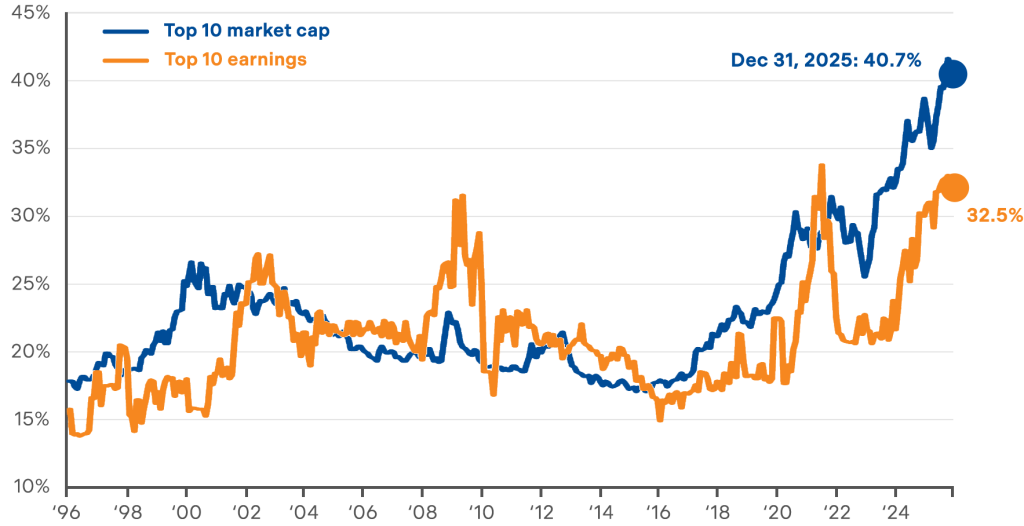

Artificial intelligence has undeniably been the driving force of today’s market. As we noted in our recent analysis, “The Trillion Dollar Question,” our view remains that we are still in the early stages of this shift, and the massive capital expenditures by hyperscalers represent a necessary retooling of the economy rather than a bubble.1 However, this enthusiasm has created an historically imbalanced US market structure. By late 2025, the top 10 stocks in the S&P 500 grew to account for approximately 41% of the entire index—a level of crowding not seen in decades.2 Consequently, many portfolios are now inadvertently exposed to a single sector, leaving investors vulnerable to volatility even if the long-term AI thesis holds true. |

|

|

| As we enter 2026, we believe the prudent strategy is not to abandon these winners, but to balance them using a “Barbell Strategy.” While the first phase of this rally was led by the “builders” of technology, we expect the next phase to be defined by “diffusion,” where the benefits of AI flow to the companies using the tools to improve profit margins in the real economy. Our belief is that US equity investors will continue to broaden their holdings in 2026. Given that Value equities were something of an overlooked segment of the market in 2025, we think it’s a natural investment evolution for US Value equities to get more attention in 2026.

This rotation is already visible in the data. The chart below tracks ‘Value’ equities versus ‘Growth’ equities returns across major regions, where readings above the zero line in the chart indicate that Value is outperforming, and readings below zero signal Growth dominance. While Value outperformed Growth in Canadian and International markets (green and blue lines) for most of 2025, the U.S. market (red line) showed a strong bias for Growth after the “Liberation Day” market turmoil. Beginning last June, the trend reversed, and now in 2026 we see all three regions showing Value returns outpacing Growth. |

| We consider Free Cash Flow (FCF) Yield to be a premier Value indicator and an excellent way to capture this shift in US investor focus. In our view, high FCF strategies act as a critical stabilizer; they allow investors to identify companies that are undervalued relative to the cash they generate today, identifying self-funding business models without having to guess which specific sector will outperform next. This approach anchors a portfolio with tangible value, providing an important counterweight to high-growth, high-valuation Tech holdings.

To execute this strategy, we created the Brompton “Cash Flow Kings” ETFs, designed to serve as the “Value” weight of the barbell. Brompton U.S. Cash Flow Kings ETF (TSX: KNGU) targets the top 50 large U.S. companies with the highest FCF yields. Because many big tech stocks are currently expensive, this strategy naturally shifts exposure away from crowded trades. It moves toward high-cash-generating companies in sectors such as Healthcare, Industrials, or Consumer Staples as well as Technology stocks with reasonable valuations, depending on where the value lies. Brompton Canadian Cash Flow Kings ETF (TSX: KNGC) serves as a powerful diversifier for Canadian investors. By explicitly excluding Financials, which dominate the Canadian index, the fund focuses purely on high cash flow generators in the rest of the Canadian market. This often results in a portfolio rich in Energy and Materials companies, which are currently generating significant cash flow, without being a forced bet on those sectors. Brompton International Cash Flow Kings ETF (TSX: KNGX) targets global leaders (excluding North America) with the highest FCF yields. This ensures that investors capture the most attractive valuations across developed markets, regardless of the industry. This provides essential geographic diversification as the global economy stabilizes. By pairing these funds with core tech holdings, we believe investors can build a resilient portfolio |

| As of December 31, 20254 | 1 Year | 3 Years | 5 Years | 10 Years | ETF Since Inception | Inception Date |

|---|---|---|---|---|---|---|

| Brompton Canadian Cash Flow Kings ETF | 39.8% | – | – | – | 28.6% | May 30, 2024 |

| Brompton Index One Canadian Cash Flow Kings Index | 40.3% | 22.4% | 22.2% | 14.9% | – | November 29, 2013 |

| Brompton U.S. Cash Flow Kings ETF | 5.7% | – | – | – | 9.0% | May 30, 2024 |

| Brompton Index One U.S. Cash Flow Kings Index | 7.3% | 18.6% | 19.8% | 15.4% | – | November 29, 2013 |

| Brompton Intl Cash Flow Kings ETF | 34.1% | – | – | – | 18.5% | July 16, 2024 |

| Brompton Index One International Cash Flow Kings Index | 34.7% | – | – | – | – | February 29, 2024 |

| 1 Brompton Funds. (2025, November 17). The Trillion Dollar Question – Are We In an Artificial Intelligence Bubble? Brompton Insights. https://www.bromptongroup.com/fd/the-trillion-dollar-question-are-we-in-an-artificial-intelligence-bubble/ 2 J.P. Morgan Asset Management. (2025). Guide to the Markets – U.S. Data are as of September 30, 2025. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/ 3 Positive values indicate Value is outperforming Growth; negative values indicate Growth is outperforming Value. Data represents the 2-month moving average of (Value-Growth) daily index returns. US: (S&P 500 Value Index – S&P 500 Growth Index). Canada: (S&P Canada LM Value Index – S&P Canada LM Growth Index). International: (MSCI EAFE Value Index US$ – MSCI EAFE Growth Index US$). 4 Source: Index One & Morningstar Direct. Returns are for the periods ended December 31, 2025 and are unaudited. The table shows the compound return for each period indicated. The information shown is based on net asset value per unit and assumes that distributions made by the ETFs during the periods shown were reinvested at net asset value per unit in additional units of the ETF. Past performance does not necessarily indicate how the ETF will perform in the future. This report is for information purposes only and does not constitute an offer to sell or a solicitation to buy the securities referred to herein. The opinions contained in this report are solely those of Brompton Funds Limited (“BFL”) and are subject to change without notice. BFL makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, BFL assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. BFL is under no obligation to update the information contained herein. The information should not be regarded as a substitute for the exercise of your own judgment. Please read the prospectus before investing. Commissions, trailing commissions, management fees and expenses all may be associated with exchange-traded fund investments. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Please read the prospectus before investing. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated. Information contained in this document was published at a specific point in time. Upon publication, it is believed to be accurate and reliable, however, we cannot guarantee that it is complete or current at all times. Certain statements contained in this document constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to matters disclosed in this document and to other matters identified in public filings relating to the ETF, to the future outlook of the ETF and anticipated events or results and may include statements regarding the future financial performance of the ETF. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Investors should not place undue reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and we assume no obligation to update or revise them to reflect new events or circumstances. |

Chris Cullen

Senior Vice President, Head of ETFs

Joining Brompton Group in March of 2006, Mr. Cullen is a CFA charterholder and is a member of the Toronto CFA Society. He graduated with a Bachelor of Applied Science in Chemical Engineering and Applied Chemistry from the University of Toronto and a Master of Business Administration from the Rotman School of Management, University of Toronto.