December 12, 2025 |

Funds in focus: Brompton Global Infrastructure ETF, Sustainable Power & Infrastructure Split Corp.

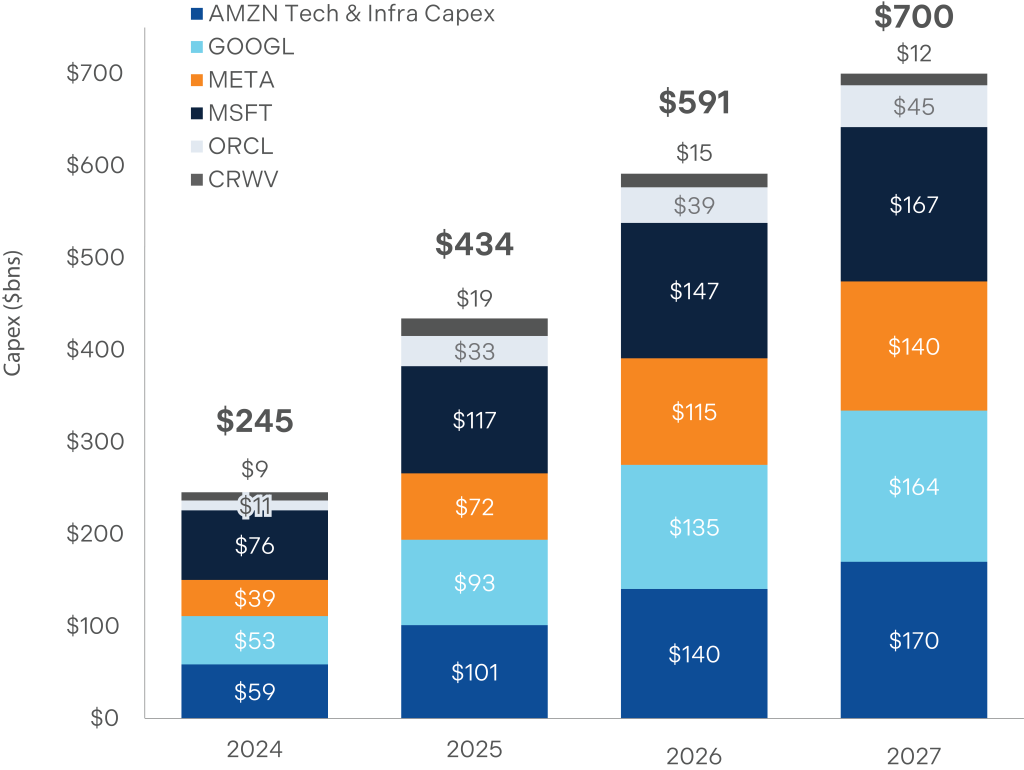

The RecapBack in February, we laid out the case for infrastructure stocks to deliver strong returns in 2025, driven by two key macro trends: the acceleration of U.S. domestic manufacturing from reshoring and the surge in electricity demand fueled by the growth in Artificial Intelligence (AI). Since then, not only does the thesis continue to hold true, but spending commitments have increased significantly. After being flat for two decades, US electricity demand is expected to grow again due largely to data centers driven by AI workloads. This substantial increase in power demand creates bottlenecks for power grids and emphasizes the continued need for major investment in infrastructure, including generation and distribution assets, and advanced cooling technologies. The reshoring trend was driven by concerns over supply chain vulnerabilities and supported by government legislation such as the CHIPS Act and also tariffs that the Trump administration was poised to enact on global imports. Spending Has Only Increased Since ThenSince the start of the year, spending commitments from hyperscalers have expanded dramatically as companies race to build out the compute required for AI training, inference, and deployment. Their aggregate capex is now expected to reach $600 billion in 2026 and another $700 billion in 20271. |

|

|

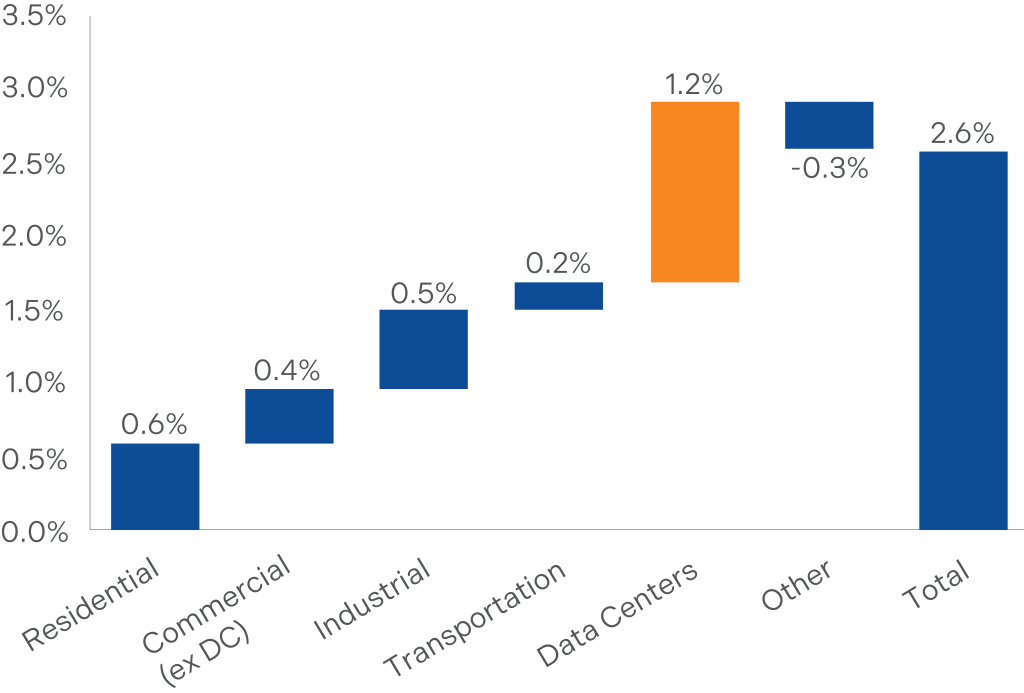

| This wave of investment is reshaping expectations for the U.S. power sector. Goldman Sachs has revised its long-term electricity consumption growth forecast to 2.6% annually through 2030, up from 2.4% earlier in the year2. The firm attributes most of this shift to the rapid rise in AI-related data center demand, with it accounting for 1.2% of that growth. It now estimates that meeting this load will require 82 GW of incremental generation capacity – up from prior estimates of 72 GW2. By 2030, data centers are projected to account for 11% of total U.S. electricity demand, versus just 4% in 20232. |

|

|

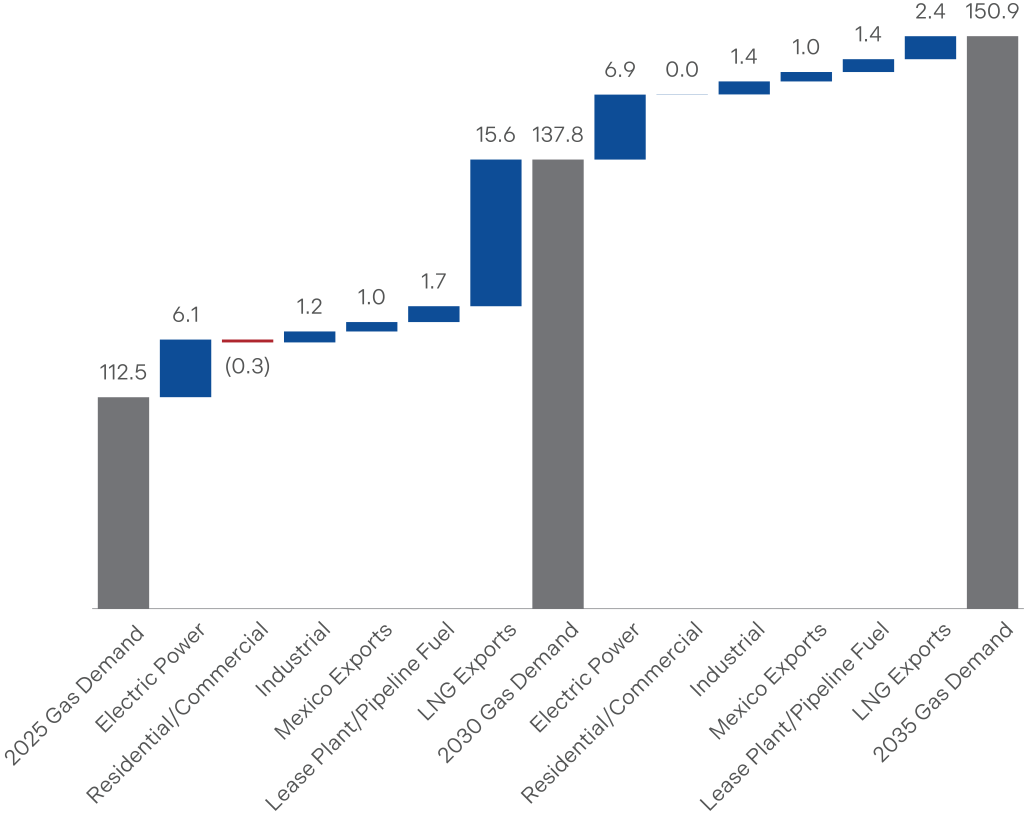

| Despite continuous improvements in chip efficiency – estimated at 9% per year – the scale of compute growth still results in net power demand expansion. To supply the required 82 GW of new generation, U.S. utilities would need to invest approximately $103 billion in additional capacity, split roughly 60% toward natural gas and 40% toward renewable sources2. Consequently, US natural gas demand is forecast to jump from 112 billion cubic feet per day (bcf/d) in 2025 to 151 bcf/d by 20353. |

|

|

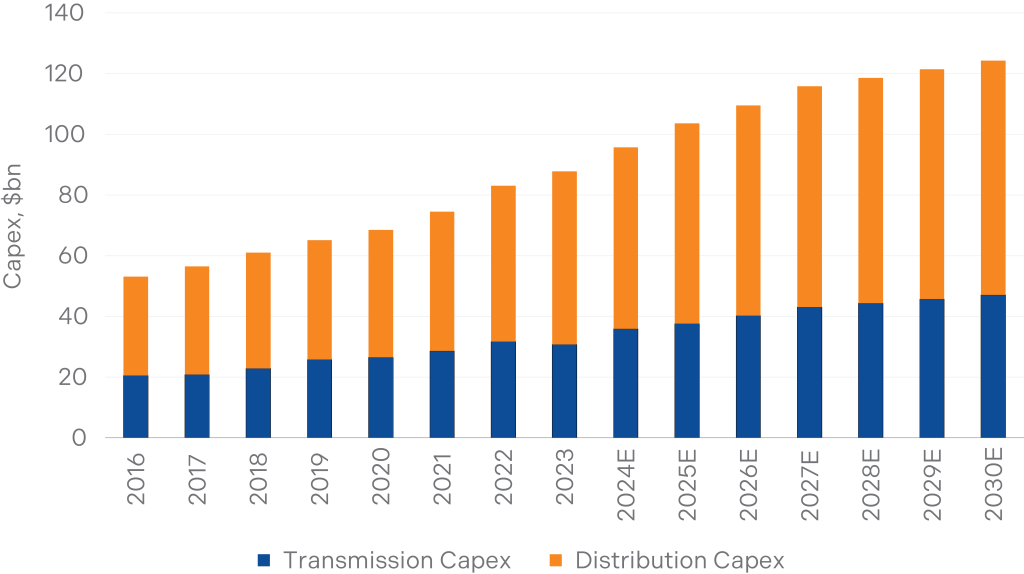

| Beyond new generation, the U.S. grid faces a second challenge: aging infrastructure. Years of chronic underinvestment have left significant portions of transmission and distribution networks in need of replacement, even before accounting for new buildout required to support data center clusters, electrification trends, and load growth. Replacing transmission networks that are between 50-80 years will require $10bn+ of annual investment4, with total estimates for grid spending (replacement & new) is a cumulative $790bn through 20305. |

|

|

Power producers, utilities, natural gas producers, and industrial companies are poised to benefit from these trends. This massive growth in electricity demand (and prices) poses challenges for power grids and emphasizes the need for energy-efficient technologies and increased investment in power generation and distribution infrastructure. This creates investment opportunities in sectors related to power generation and distribution. This includes utilities, renewable power producers, grid equipment companies and HVAC producers.

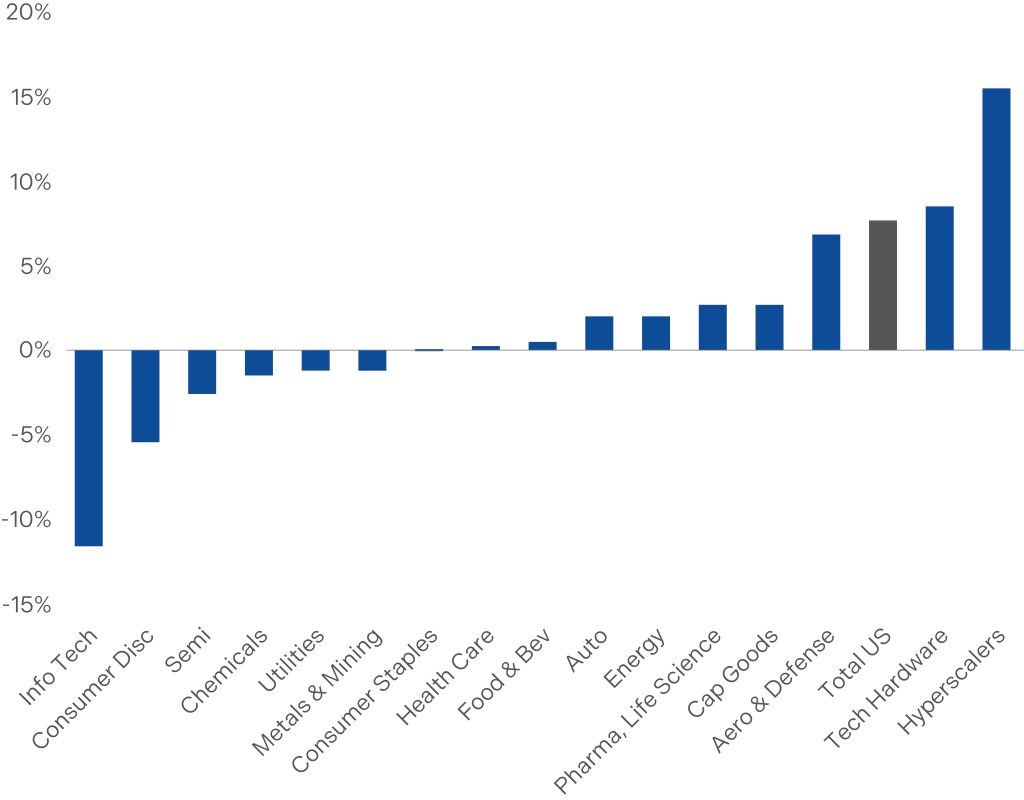

Not Just AI, Reshoring Playing a Part TooThe reshoring trend, in which companies bring manufacturing and production back to the United States, has gained significant momentum in recent years. This shift was initially driven by factors such as supply chain vulnerabilities exposed during the COVID-19 pandemic, geopolitical tensions, and a growing emphasis on national security and economic resilience. The most significant catalyst, however, has emerged more recently. With Donald Trump’s return to office, a new wave of tariffs on global imports has materially altered the economics of offshore production. Companies across a broad range of sectors are re-evaluating their global footprints, with many now actively considering – or already committing to – new U.S. manufacturing facilities to mitigate tariff exposure and protect access to the world’s largest and most profitable consumer market. Although the US represents roughly 30% of global consumption, it accounts for only 16% of global production6, underscoring the magnitude of the reshoring opportunity. It is also a large market in terms of demand, and the highest margin region in the world. For industrial companies, the strategic incentive is clear: aligning production with consumption reduces supply-chain risk while positioning firms closer to the market that delivers the highest margins. The early indicators of this shift are already becoming visible. U.S. machinery orders have shown a meaningful uptick, reflecting growing demand for automation, equipment, and plant-level expansion tied to domestic buildout7. While hyperscalers continue to dominate the capex narrative with massive AI-driven spending plans, the broader industrial landscape is also seeing strengthening investment activity across multiple verticals8. |

|

|

| Taken together, these developments point to a broad-based U.S. capital expenditure cycle. What began as a response to global disruptions has now evolved into a sustained reindustrialization trend, underpinned by policy, economics, and strategic necessity. The implications for the U.S. industrial sector are significant: higher capital spending, improved margins, and a long runway for domestic investment growth.

Governments in both the US and in Canada are trying to make it easier to get these infrastructure projects off the ground. In the US, the federal government has recently moved to modernize and accelerate the permitting process for infrastructure projects by embracing new technology. It has issued a directive requiring agencies to adopt digital permitting systems, eliminate paper-based reviews, reduce duplication between reviews, and make environmental-permit schedules more transparent and predictable9. At the same time, regulatory guidance under the National Environmental Policy Act (NEPA) has been updated to streamline what had become a slow, fragmented review regime across federal agencies10. Meanwhile in Canada, the government of Mark Carney has introduced legislation to fast-track “national interest” infrastructure projects: a new central body, the Major Projects Office (MPO), has been established to coordinate financing and approvals, and the aim is to reduce approval timelines to two years or less under a “one project, one review” framework11. The verticals best positioned for reshoring are those where global demand for capacity is high, including semiconductors, electrical equipment (such as transformers, switch gears, and HVAC systems), electric vehicles, batteries, and aerospace. Companies in the Electrical and Automation sectors, are poised to benefit once these new facilities are operational. Brompton’s ApproachInvestors can get exposure to the growth opportunities in infrastructure that are being driven by reshoring and AI though investing in Brompton Global Infrastructure ETF (BGIE) or Sustainable Power & Infrastructure Split Corp. (PWI). Brompton Global Infrastructure ETF (BGIE) invests in a diversified, actively managed portfolio of global infrastructure companies, which may also include their suppliers of services or equipment. An active covered call writing program is used to generate additional income and reduce overall portfolio volatility. BGIE offers stable monthly cash distributions, yielding 5.1% as of November 28,2025. Sustainable Power & Infrastructure Split Corp. (PWI)‘s Class A shares offer leveraged exposure to a globally diversified portfolio of sustainable power and infrastructure companies for investors seeking enhanced capital appreciation potential and high monthly cash distributions, offering a yield of 9.6% as of November 28, 2025. |

|

1 Morgan Stanley, October 31 2025. 2 Goldman Sachs, October 13 2025 (America Utilities). 3 Morgan Stanley, Future of Power, October 28, 2025. 4 Quanta Services Investor Presentation, November 10, 2025. 5 Goldman Sachs, October 13, 2025 (Data Centers). 6 Morgan Stanley research, November 7, 2024. Learnings from Trump 1.0, Expectations for 2.0. 7 Morgan Staney, November 17, 2025. 8 Morgan Staney, November 24, 2025. 9 The White House (April 18, 2025). President Trump Unleashes Permitting Technology for the 21st Century. 10 The White House (September 29, 2025). CEQ Releases Guidance to Streamline NEPA Reviews. https://www.whitehouse.gov/articles/2025/09/ceq-releases-guidance-to-streamline-nepa-reviews/ 11 Prime Minister of Canada (September 11, 2025). Prime Minister Carney announces first projects to be reviewed by the new Major Projects Office. https://www.pm.gc.ca/en/news/news-releases/2025/09/11/prime-minister-carney-announces-first-projects-be-reviewed-new 12 Returns are for the periods ended November 30, 2025, and are unaudited. The tables show the compound return on the units of Brompton Global Infrastructure ETF and the Class A shares of Sustainable Power & Infrastructure Split Corp. for each period indicated. Past performance does not necessarily indicate how the funds will perform in the future. The performance information shown is based on the net asset value per unit or net asset value per Class A Share, as applicable, and assumes that cash distributions made by the funds on their units or Class A Share, during the periods shown were reinvested at the net asset value per unit or net asset value per Class A Share in additional units or Class A Shares of the respective fund. Past performance does not necessarily indicate how the funds will perform in the future. This document is for information purposes only and does not constitute an offer to sell or a solicitation to buy the securities referred to herein. The opinions contained in this report are solely those of Brompton Funds Limited (“BFL”) and are subject to change without notice. BFL makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, BFL assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. BFL is under no obligation to update the information contained herein. The information should not be regarded as a substitute for the exercise of your own judgment. Please read the annual information form or prospectus, as applicable, before investing Commissions, trailing commissions, management fees and expenses all may be associated with exchange-traded fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income tax payable by any securityholder that would have reduced returns. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated. You will usually pay brokerage fees to your dealer if you purchase or sell shares of the investment funds on the Toronto Stock Exchange or other alternative Canadian trading system (an “exchange”). If the shares are purchased or sold on an exchange, investors may pay more than the current net asset value when buying shares of the investment fund and may receive less than the current net asset value when selling them. There are ongoing fees and expenses with owning shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in the public filings available at www.sedarplus.ca. The indicated rates of return are the historical annual compounded toral returns including changes in share value and reinvestment of all distributions and do not take into account certain fees such as redemption costs or income taxes payable by any securityholder that would have reduced returns. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Information contained in this document was published at a specific point in time. Upon publication, it is believed to be accurate and reliable, however, we cannot guarantee that it is complete or current at all times. Certain statements contained in this document constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to matters disclosed in this document and to other matters identified in public filings relating to the funds, to the future outlook of the funds and anticipated events or results and may include statements regarding the future financial performance of the funds. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Investors should not place undue reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and we assume no obligation to update or revise them to reflect new events or circumstances. |

Utsav Srivastava

Investment Analyst

Utsav Srivastava specializes in equity selection with a focus on the global industrial, utilities, and real estate sectors. Mr. Srivastava graduated with a Master Business Administration from the Rotman School of Management at the University of Toronto and has passed CFA Level 3. He received his Bachelor of Arts degree in Economics from the University of British Columbia.