February 13, 2026 |

| Funds in focus: Brompton Global Healthcare Income & Growth ETF

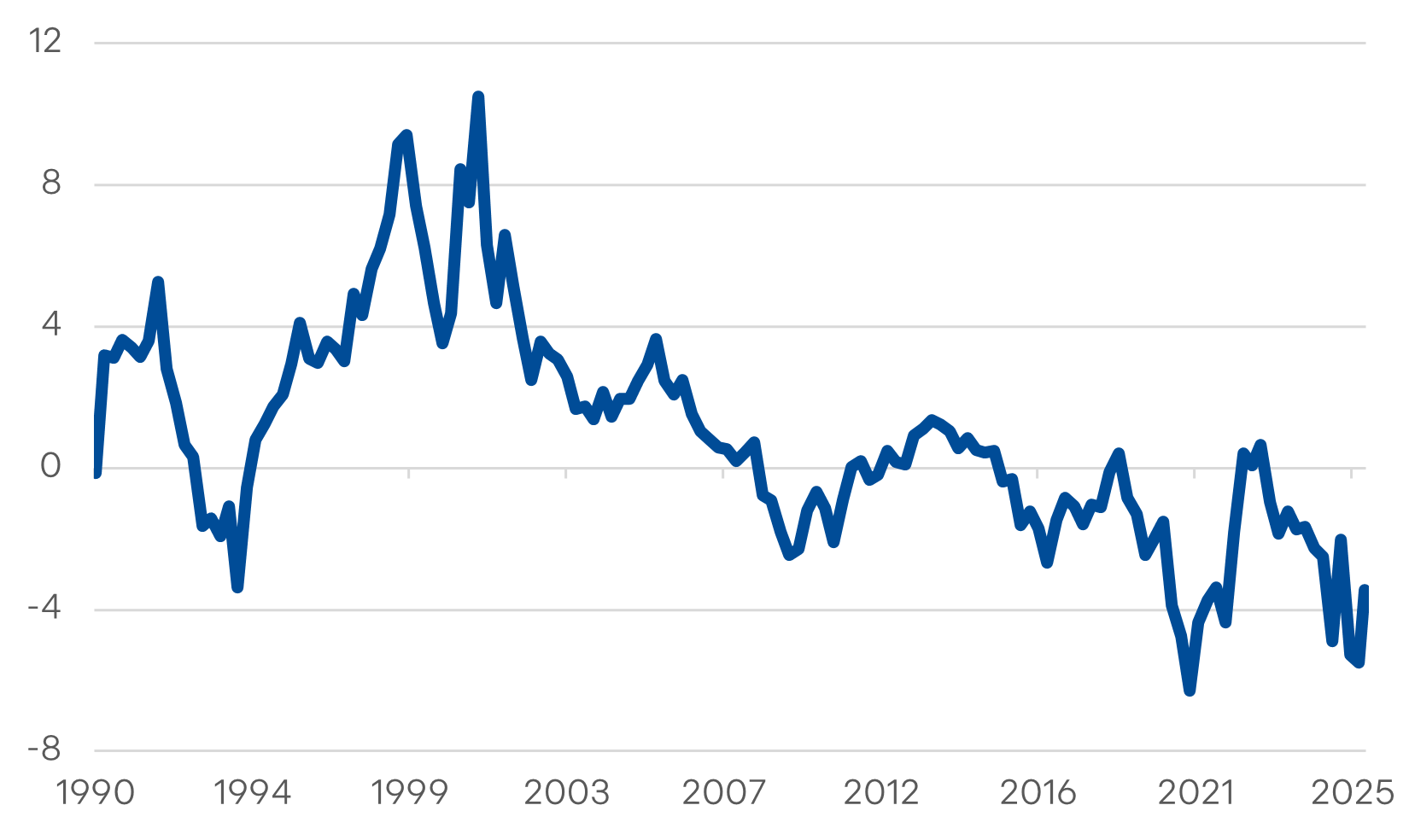

Healthcare has lagged the broader market in recent years, particularly in 2024 when the S&P 500 Healthcare Total Return Index was up 2.6% versus the S&P 500 Index up 25%.1 We believe this can be attributed to political debates over drug pricing, uncertainty around Medicare negotiations, tariff concerns, delays at the FDA, and rising medical costs at insurers. As a result, sector valuation sits in the bottom 6th percentile of the last 30 years, signaling deep discounts relative to long-term history (see Figure 1). We believe healthcare is entering one of the most attractive investment environments it has seen in years. A combination of falling interest rates, improving earnings, attractive valuations, easing policy risk, and a strengthening merger-and-acquisition (M&A) cycle is now coming together. These forces create a powerful setup for long-term investors. In 2025, the performance gap between healthcare and the broader market narrowed, 14.6% versus 18% respectively with significant outperformance in Q4, 12% versus 3%.1 Despite recent gains, healthcare is still under-owned by investors given its longer-term lag. We believe this under positioning could provide additional performance tailwind beyond just fundamentals and improving macro environment. |

|

|

Interest Rate Cuts: A Catalyst for Healthcare and Biotech OutperformanceAs central banks move toward cutting interest rates, this shift becomes a major positive for healthcare. Historically, healthcare stocks tend to outperform the broader market about 6 to 12 months after the first interest rate cut. Among all areas of healthcare, biotechnology has been the strongest performer during these periods. Why does this happen? Biotech companies often derive most of their value from drugs still in development, meaning much of their earnings lie in the future. When rates fall, those future profits become more valuable in today’s terms. Lower rates also make it easier for companies to raise capital and for investors to take on more growth-oriented investments. Together, these forces naturally benefit innovation-driven sectors like biotech. Policy Clarity Reduces UncertaintyMany of the policy risks that hurt the sector over the past two years are now becoming more predictable. Companies are working with the Trump administration on tariffs and drug prices. To reduce the impact of tariffs, many are shifting more production to the U.S. and managing inventory more carefully. They are also adjusting prices on new drugs to reduce the gap between U.S. and international pricing. Recent FDA drug approval decisions show the process is stable and predictable, making approval timing less risky. Clearer rules from Medicare on drug pricing are also reducing uncertainty that had been weighing on the industry. M&A Activity Supports Higher ValuationsLarge pharmaceutical companies face a historic challenge. Over the rest of this decade, many of their highest revenue drugs will lose patent protection. This is known as the “patent cliff,” and it represents roughly $177 billion in at-risk revenue.2 When patents expire, generic competition rapidly erodes sales. To replace this lost income, major drug companies must acquire new medicines—and the fastest way to do that is by purchasing innovative biotech firms. This strategic necessity is now driving a renewed and powerful M&A cycle. In 2025, roughly $72 billion in biotech and biopharma deals have already been announced, and deal activity has clearly accelerated in recent months.2 These acquisitions often trigger sharp price increases in the companies being bought and raise valuations across the broader sector. Earnings Momentum Signals an Attractive Entry PointWe note that earnings momentum has turned positive for the healthcare sector. Across pharmaceuticals, biotech, medical devices, and healthcare services, analysts are now revising earnings estimates higher more often than they are cutting them based on our observation from Bloomberg consensus estimates. This is one of the most important signs of a healthy investment cycle. Historically, stock prices follow earnings growth—and today, prices have not yet fully reflected this improving outlook. This creates an attractive entry point for investors ahead of broader recognition. Brompton’s ApproachBrompton Global Healthcare Income & Growth ETF (HIG, HIG.U) provides exposure to an actively managed portfolio of large cap global healthcare companies. In addition, we actively manage the healthcare weighting across our global dividend portfolios (BDIV, GDV, EDGF). We prefer to invest in large capitalization healthcare companies that are market leaders with solid commercial product pipelines, versus early-stage healthcare companies. We believe this strategy provides better risk-adjusted returns, particularly in an inflationary environment. In addition, a diversified product pipeline mitigates risks associated with patent cliffs. We actively manage the subsector weightings within healthcare and use a call writing overlay to harvest volatility risk premium which enhances risk-adjusted returns. |

Varun Choyah

Assistant Vice President & Associate Portfolio Manager

Mr. Choyah specializes in equity security selection with a focus on the global technology and healthcare sectors. Previously, he was a research associate covering technology equities at various Canadian investment dealers for nearly a decade.