Discover Split Share Funds

Uniquely designed for high income and enhanced growth

Preferred Shares

- Provide steady income and downside protection.

- Best suited for conservative investors.

- Historically outperform the Canadian preferred share market with lower volatility.

Discover SPLT

Class A Shares

- Offer enhanced growth potential.

- Best suited for investors seeking high income and growth.

- Historically outperform their broader indices.

Discover CLSA

Overview

A Split Share fund (Split Corp.) is uniquely designed to provide attractive income and growth opportunities to investors.

Split Share funds typically invest in portfolios of high-quality, dividend-paying stocks and they issue two distinct classes of shares to investors: Preferred shares and Class A shares. Both classes of shares are exchange-traded and can be purchased and sold just like ETFs or stocks.

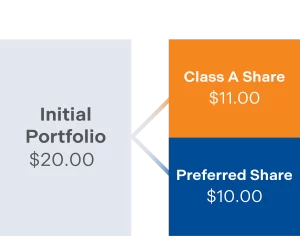

Illustrative example of a Split Corp.:

| Preferred Shares | Class A Shares | |

|---|---|---|

| Conservative and income-oriented | Seeking growth and high cash flow | |

| Fixed income | Equity | |

Fixed, cumulative quarterly eligible dividends |

Yes* Yes*Tax-advantaged distributions |

|

Capital Appreciation Capital Appreciation |

Yes Yes |

|

Yes YesCapture the price movement of the portfolio |

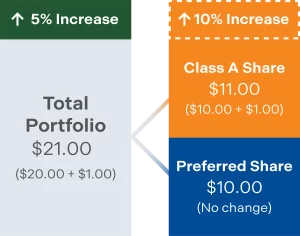

Class A shares get the benefit of enhanced returns, while Preferred shares are protected from gains/losses in the portfolio.

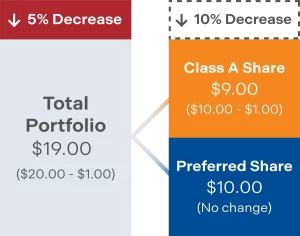

To see how the shares will react in different market scenarios, let’s review an hypothetical example where the Split Corp. issues 1 Preferred share and 1 Class A share, at a price of $10.00 per share. The Split Corp. has $20.00 of capital to invest in a portfolio of dividend-paying stocks.

Initial Portfolio

Scenario 1

Market increase, the portfolio gains 5%.

Scenario 2

Market decline, the portfolio loses 5%.

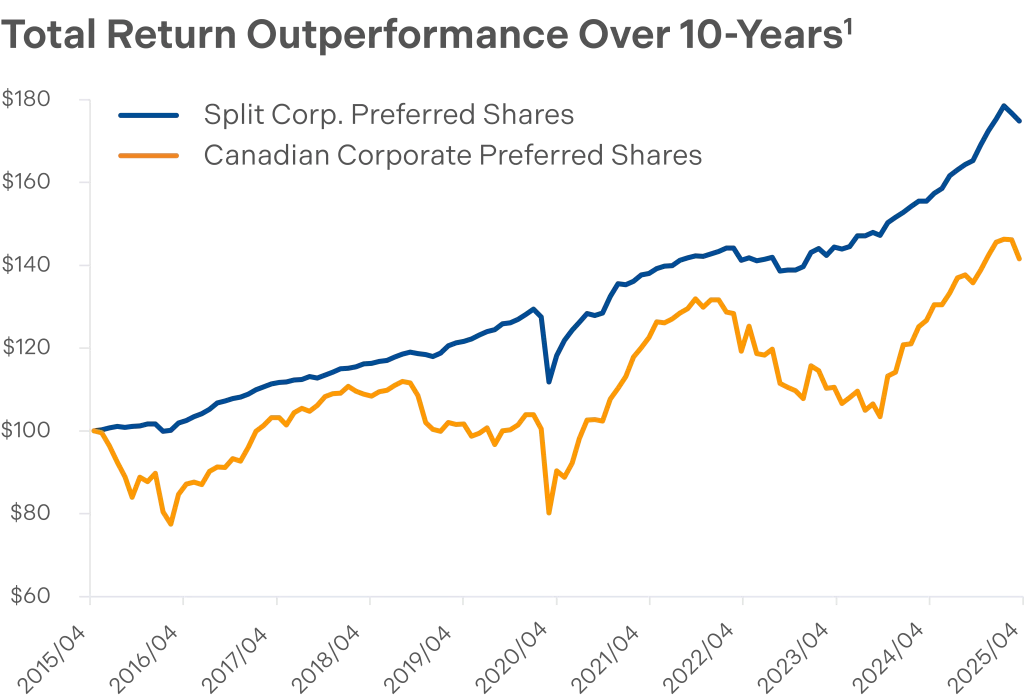

Split Corp. Preferred Shares Outperform with Lower Volatility

Split Corp. Preferred shares are best suited for investors seeking stability because of their capital protection. They have historically outperformed the Canadian corporate preferred share market with lower volatility.

Better Returns with Split Corp. Class A Shares over time

If you wish to go “long” a sector or theme covered by a Split Share fund, Class A shares provide investors an opportunity to generate higher returns compared to a direct investment in those holdings.

Looking for more information on Split Share Funds?

Find out more on the unique Canadian investment with Brompton’s Split Share Primer.

Brompton Split Share Funds

Our Split Share funds focus on sectors such as banks, life insurance companies, energy and infrastructure, as well as more diversified portfolios of Canadian and global dividend growth stocks.

| Ticker | Fund | Portfolio Holdings | Current Distribution Rate3 |

|---|---|---|---|

| DGS | Dividend Growth Split Corp. | Canadian Large-cap Dividend Growers | 14.37% |

| ESP | Brompton Energy Split Corp. | Global Energy | 15.00% |

| GDV | Global Dividend Growth Split Corp. | Global Large-cap Dividend Growers | 9.02% |

| LBS | Life & Banc Split Corp. | Canada’s ‘Big 6’ Banks and 4 Largest Lifecos | 9.79% |

| LCS | Brompton Lifeco Split Corp. | Canada’s 4 Largest Lifecos | 10.17% |

| PWI | Power & Infrastructure Split Corp. | Global Power & Infrastructure | 9.22% |

| SBC | Brompton Split Banc Corp. | Canada’s ‘Big 6’ Banks | 9.65% |

Simplify your investing strategy by choosing one of our ETF investing solely in Split Corp. Class A Shares (CLSA) and Preferred Shares (SPLT). Both ETFs are actively managed by Brompton’s Portfolio Managers – experts in split shares. Both ETFs have diversified portfolios of Canadian listed Split Corp. shares.

| Ticker | Fund | Portfolio Holdings | Current Distribution Rate3 |

|---|---|---|---|

| CLSA | Brompton Split Corp. Enhanced Equity Income ETF | Split Corp. Class A Shares offered by Canadian split share corporations | 12%** |

| SPLT | Brompton Split Corp. Preferred Share ETF | Split Corp. Preferred Shares offered by Canadian split share corporations | 6.07% |

Our Split Share funds focus on sectors such as banks, life insurance companies, energy and infrastructure, as well as more diversified portfolios of Canadian and global dividend growth stocks.

| Ticker | Fund | Portfolio Holdings | Current Distribution Rate3 |

|---|---|---|---|

| DGS.PR.A | Dividend Growth Split Corp. | Canadian Large-cap Dividend Growers | 6.46% |

| ESP.PR.A | Brompton Energy Split Corp. | Global Energy | 7.11% |

| GDV.PR.A | Global Dividend Growth Split Corp. | Global Large-cap Dividend Growers | 4.76% |

| LBS.PR.A | Life & Banc Split Corp. | Canada’s ‘Big 6’ Banks and 4 Largest Lifecos | 6.70% |

| LCS.PR.A | Brompton Lifeco Split Corp. | Canada’s 4 Largest Lifecos | 6.64% |

| PWI.PR.A | Power & Infrastructure Split Corp. | Global Power & Infrastructure | 4.91% |

| SBC.PR.A | Brompton Split Banc Corp. | Canada’s ‘Big 6’ Banks | 6.02% |

From our Split Share Experts

Sources and Disclosures

* For Split Share funds managed by Brompton Funds Limited, no distributions will be paid on the Class A Shares if (i) the distributions payable on the Preferred Shares are in arrears, or (ii) in respect of a cash distribution, after the payment of a cash distribution by the Company the NAV per Unit would be less than $15.00.

(1) Source: LSEG Datastream, as at April 30, 2025. Split Corp. Preferred Shares = Brompton Index One Split Preferred Shares Index, Canadian Corporate Preferred Shares = S&P/TSX Preferred Share Index.

(2) Source: Brompton, LSEG Datastream, as of April 30, 2025. Canadian Equity Index = S&P/TSX Composite Total Return Index. Canadian Financials Index = S&P/TSX Capped Financials Total Return Index. DGS = Dividend Growth Split Corp. Class A Financials = Brompton Lifeco Split Corp. (TSX: LCS), Brompton Split Banc Corp. (TSX: SBC), and Life & Banc Split Corp. (TSX: LBS), assuming an equal weighting on April 30, 2015. Class A share performance is based on net asset value and assumes distributions made by each Fund on its Class A shares were reinvested at net asset value in additional class A shares of each respective Fund.

February 27, 2026

**Target annualized distribution based on initial issue price of $10.00.

This document is for information purposes only and does not constitute an offer to sell or a solicitation to buy the securities referred to herein. The opinions contained in this report are solely those of Brompton Funds Limited (“BFL”) and are subject to change without notice. BFL makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, BFL assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. BFL is under no obligation to update the information contained herein. The information should not be regarded as a substitute for the exercise of your own judgment. Please read the annual information form or prospectus before investing.

You will usually pay brokerage fees to your dealer if you purchase or sell shares of the investment fund on the TSX or alternative Canadian trading platform (an “exchange”). If the shares are purchased or sold on an exchange, investors may pay more than the current net asset value when buying shares of the investment fund and may receive less than the current net asset value when selling them.

There are ongoing fees and expenses associated with owning shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in the public filings available at www.sedarplus.ca. The indicated rates of return are the historical annual compounded total returns including changes in share value and reinvestment of all distributions and do not take into account certain fees such as redemption costs or income taxes payable by any securityholder that would have reduced returns. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Commissions, trailing commissions, management fees and expenses all may be associated with exchange-traded fund investments. Please read the prospectus before investing. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

Information contained in this document was published at a specific point in time. Upon publication, it is believed to be accurate and reliable, however, we cannot guarantee that it is complete or current at all times. Certain statements contained in this document constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to matters disclosed in this document and to other matters identified in public filings relating to the Funds, to the future outlook of the Funds and anticipated events or results and may include statements regarding the future financial performance of the Funds. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Investors should not place undue reliance on forward looking statements. These forward-looking statements are made as of the date hereof and we assume no obligation to update or revise them to reflect new events or circumstances.